The concept of wine as an investment has taken on a completely new meaning in recent years. Traditionally, wine investment was low-key - something that people merely dabbled in, buying a couple of cases of a wine and hoping to sell one to fund the drinking of the other.

Nowadays things are a little different. With the arrival of several new and important markets and regular coverage throughout the press, wine investment has to be taken a great deal more seriously, with cases of first growths that once cost £1,000 on release just a few years ago, now selling for considerably more.

The fine wine industry is not regulated, and Farr Vintners is not a financial institution. As such, we do not give financial advice or any guarantees about the potential increase in a wine’s value.

Farr Vintners is one of the world’s leading wine merchants, and as such we are qualified to give information regarding vintages and wines, their quality and prevailing market conditions. This information is based upon our knowledge, acquired from over 40 years of trading, and our daily dealings in the global wine market. Using our knowledge of this market, we can provide valuations for wines and, in conjunction with past performance of wines, we can give you our informed opinion as to whether a wine may have the ability to accrue value.

Farr Vintners does not charge a management fee and there are no hidden fees involved. The only money that you will pay is your purchase price and any storage fees applicable (see below). When you come to sell your wines, you are not tied to selling through us, although we will make you as competitive an offer as possible.

Wines can go down, as well as up in value, and there are many things that can influence these price movements. We would urge you to read around the subject fully before making a decision, and our staff are available to answer any questions that you may have.

For specific financial advice, the tax implications or any other financial element of wine investment, it is important to speak to an accredited financial advisor.

.jpg)

Correct Wines

Always get advice on the specifics of the wine/vintage from an established merchant with a good reputation. Many wines that you may think will do well possibly have no history of having traded at a profit. Farr Vintners can provide you with information on previous performance, current market situations and vintage details. We have been trading for more than 40 years, we are one of the largest fine wine merchants in the world, and the collective experience of our sales and purchasing team is second to none.

Provenance

Only buy wines in their original cases, in good condition and that have good provenance. Reputable merchants will be able to tell you about the provenance of specific wines. Farr Vintners will only recommend wines that have excellent provenance. We have strict buying and stock admission systems, ensuring all our wines meet these requirements.

In Bond

Make sure that you do not unnecessarily pay tax (duty and VAT) – buy your wines under bond (ex-UK duty and VAT) and sell them under bond. A wine’s resale value is not increased if the tax has already been paid. The vast majority of the cases that we offer for sale are offered in bond.

Storage

Make sure that once paid for, the wine you have bought is stored in a professional storage facility, is registered in your name and is fully insured. All of our wines, including wines held on behalf of our customers, are stored at our bonded warehouse in Melksham, Wiltshire. This is a bespoke, modern facility created exclusively for Farr Vintners by London City Bond. Temperature and humidity levels are computer-controlled at a constant 13 degrees celsius and 70% respectively, offering ideal and secure conditions for fine wine storage. Our current storage charge is a very competitive £14.40 per 9 litre case per year (£7.20 per 4.5 litre case), plus VAT. Any wine that you store with Farr Vintners is automatically insured at full replacement value.

Investment Term

Fine wine improves with age, and therefore supply/demand economics suggest that the longer a wine is held, the more valuable it should become. We suggest that you should not purchase wines for investment unless you are prepared to wait for a minimum of five years. The market may well allow returns to be seen within five years, but a good rule-of-thumb is to have a minimum term of five years in your mind when venturing into wine investment.

Supply and Demand

The historical argument for investing in wine was largely based on a wine’s capacity to improve with age. As a wine matured and improved, demand would rise and, at the same time, supply would fall as it was consumed. This still holds true, but equally pertinent is the rise of global wealth, and a resulting rise in demand for the very best. Over the past ten to twenty years the fine wine market has witnessed unprecedented demand, driven mainly from relatively new markets becoming involved in drinking and investment, especially that of China (and Asia more generally). Recently, the correct wines that have proven track records in accruing value have performed, comparatively, very well against more traditional investments.

Moreover, great wines have limited production: a château cannot produce more of an older vintage - that is simply not possible. Therefore, if a wine is traded and consumed over several years, yet demand remains constant or grows, the net result is that the price should rise. Scarcity is a key factor affecting price.

Physically Available

Fine wine is unlike a stock or share – it is a tangible asset that sits in a warehouse, legally held in your name.

.jpg)

Lack of Regulation

The fine wine market is not regulated. As such there are many potential pitfalls, mainly stemming from bad advice and incorrect pricing. It is essential to take honest and qualified advice from a reputable and established merchant and, moreover, to do your research on both the wines that are being sold to you and the merchant that is selling them.

The Nature of Investment

Any investment has the potential to lose money as well as make money. Fine wine is no different, and despite the fine wine market being relatively well insulated from the macro economy compared to other investments, the possibility of losing money is a real one and should not be ignored.

If you would like to find out more, we encourage you to contact us here at Farr Vintners. We are one of the world’s leading fine wine merchants, renowned for being very competitive on pricing, as well as being experts in our field. We believe that we offer an unrivalled service when it comes to buying, selling and managing fine wine.

For further information please email us at sales@farrvintners.com or phone us on +44 (0)20 7821 2000.

If you are based in Asia, please contact our Hong Kong team at info@farrhk.com or telephone +852 2575 8773

.jpg)

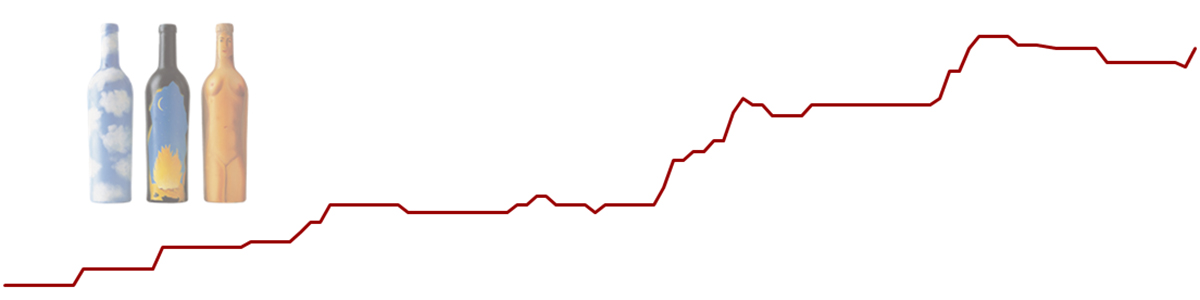

In the latter half of the 2000s, the fine wine market saw an unprecedented boom. This was driven by both demand from the Far East, and further speculative demand following the extraordinary rise in prices. Fine Wine Funds proliferated, and the market overheated. To add to this, the brilliant 2009 and 2010 Bordeaux vintages were released into this market at unprecedentedly high prices and, in the summer of 2011, the speculative bubble burst. The resulting correction saw prices fall by as much as 40% in some cases.

The following 10 years saw a fairly flat market, particularly for the wines of Bordeaux (though the rarest Burgundies from a handful of top producers continued to rise in price).

Trade, and prices, strengthened considerably throughout 2021. US tariffs on EU wines were suspended at the beginning of March, and this saw an almost immediate bounce in demand. At the same time, demand for prestige cuvée Champagnes from top vintages started to warm up; the heat in this particular market continued throughout the year, and well into 2022.

The very best wines from Burgundy, particularly from domaines such as DRC, Rousseau, Leroy and d’Auvenay, also saw remarkable demand in 2021 and 2022; pristine cases of the very rarest wines from the most exclusive growers changed hands for unprecedented prices. The market tends to pause for a while after serious hikes, which is a fair summary of what happened in the Spring of 2023, with many of these wines now available at discounts.

We also saw an intriguing rise in demand for a handful of previously unheard of growers and micro-negociants in Burgundy; whether or not this continues in the longer term remains to be seen.

2023 saw a slowdown in the market and prices started to come down. A combination of global economic uncertainty, high interest rates and fears of inflation added to a fall in demand from the Far East, which was compounded by a strong pound.

In May and June 2023, an over-priced 2022 Bordeaux en primeur campaign sucked a great deal of positivity out of the Bordeaux market though, to many, these wines did and do make back vintages of Bordeaux, especially 2009, 2010, 2016 and 2019, look more and more attractive in terms of relative value. The second half of 2023 saw prices drift further and this trend continued through to 2024.

By the end of 2024 the market was as soft as we had seen for two decades. The 2023 Bordeaux en primeur campaign was another missed opportunity, with many châteaux failing to cut prices by anywhere near what was required; in many cases superior back vintages, 2019 in particular, were and are available for less. The 2024 “September Releases”, a growing selection of wines released through Bordeaux negociants were, for the most part, priced unrealistically and this only added to negative market sentiment.

January 2025 saw, perhaps, some green shoots and cautious optimism paired with a modest uptick in sales if not prices, though this was short-lived. April saw the on/off/on/off threat of tariffs imposed by the new President of the United States and this, combined with a new level of global uncertainty – both economic and political – has sucked much enthusiasm from the market.

It may be the case that we are approaching the time when the strongest opportunities start to present themselves – there is a great deal of wine available that looks more and more under-valued each day, and big ticket wines are selling when the right price can be found. But while buyers sit on their hands, the Far East market remains quiet, interest rates stay relatively high and the world continues to want for certainty, it remains to be seen just when things will pick up.